- How to finance a small business purchase with an SBA loan

- How to combine your personal funds with other financing options

- How to take advantage of seller financing to help fund a business purchase

- How equity investments can help you cover your down payment

The problem isn’t new: approximately 10,000 baby boomers are retiring every day and nearly 16 million business owners will be at or above retirement age in the next ten years. That represents trillions of dollars worth of business assets that need to switch hands because otherwise, millions of jobs would be at risk.

This situation has birthed the Acquisition Through Entrepreneurship movement.

Because of this massive flood of businesses and the potential employment problem it could create, the Federal government has stimulated Main St. with funding through the SBA to encourage more transactions.

This low cost of capital has made the concept of buying a business make much more financial sense than starting one yourself or becoming a franchisee. These people are known as Acquisition Entrepreneurs. Purchasing an established business offers the benefits of acquiring a company with a proven track record, financial statements, and a customer base, which can ease the process of obtaining financing and reduce initial challenges.

However, an SBA loan isn’t the only way to purchase a business. In this article, we’ll dive into eight different ways you can get the money to buy a small business. Understanding the various methods of business acquisition financing is crucial for anyone looking to purchase a business.

We also provide a free tool to help you calculate different possible loan terms and see what you stand to make after exiting the business.

So, intrepid business buyers, let’s dive in!

Understanding Your Business Needs

When considering how to finance a small business purchase, it’s essential to understand what you need out of the business financially. This involves a thorough evaluation of the business’s financial statements, cash flow, and assets to determine the most suitable financing option. Additionally, assessing the business’s growth potential, industry trends, and market conditions is crucial to ensure you’re making an informed decision.

To gain a comprehensive understanding of your business needs, consulting with a financial broker can be invaluable. These professionals can help you assess the business’s financial health and identify potential financing options relative to your personal finances. They can also help you determine the best way to structure your deal.

By thoroughly understanding your business needs, you can make informed decisions about financing options and ensure that you’re securing the right loan for your business.

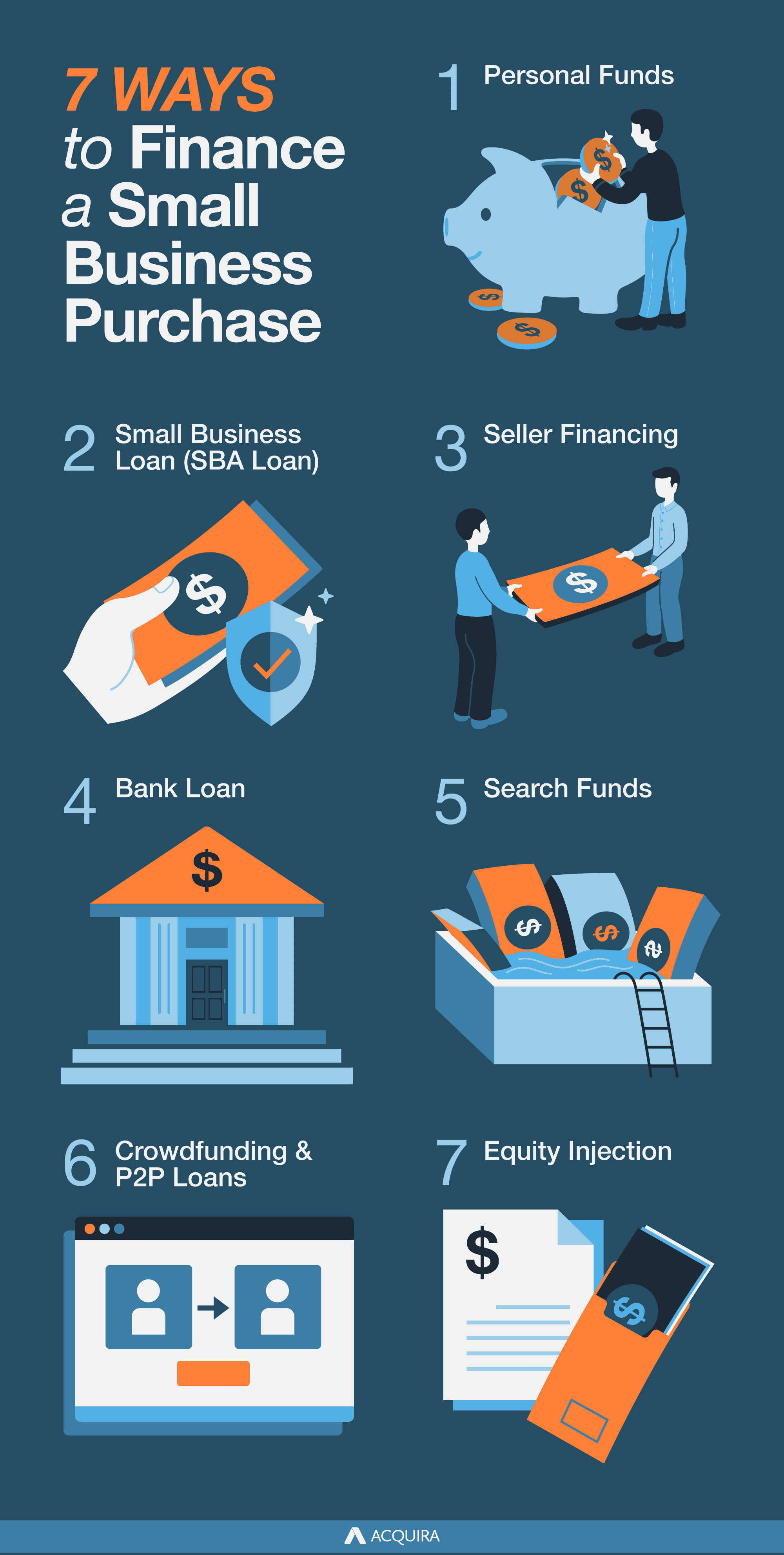

7 Ways to Finance a Small Business Purchase

Whether you are a novice entrepreneur trying to finance your first purchase of a small business or an established entrepreneur looking for a small business acquisition to expand your portfolio, you need money.

What options are available to obtain financing to fund this? A bank loan or your own savings? Asking a friend or applying for a line of credit? There are no rights and wrongs when it comes to getting the money to buy a small business.

Your choice will depend on your unique situation — the nature of the business, the size of the business, the various legal and regulator requirements, etc. It’s important to note that it is often possible to combine funding sources in order to acquire a business. For example, an SBA loan is often combined with seller financing to cover the loan, while a certain amount of equity could be given up in order to cover the down payment. Acquisition loans are another viable option, specifically designed for purchasing business assets and often secured by the asset being acquired. There are many combinations you can work with.

1. Personal Funds

The first and easiest source of financing for your next business acquisition is using your own money. You might have enough funds in your bank to buy the business. Having stock investments can also be a potential source of funding.

Many people think of mortgaging their homes, but this is not recommended. Remember, only invest the money that you can afford to lose.

Financing a business purchase with cash is a rare practice and if you do this you will forgo the opportunity to further grow your investment through leveraging it. There is almost always a combination of equity financing and debt financing. You can fund the down payment from your personal funds and choose other ways to finance the remainder.

2. Small Business Loan (SBA Loan)

The Small Business Administration connects entrepreneurs with lenders and provides guarantees to the lenders instead of issuing the loan amount itself. This is without a doubt the most popular method of funding a small business acquisition and requires any Acquisition Entrepreneur to file an application for an SBA loan.

Compared to alternative funding options like private equity and seller financing, small business loans are an excellent option for individual buyers. When considering how to finance buying a business, SBA loans are considered less risky loans for the banks; therefore, they offer lower rates to the applicants.

You can apply for SBA loans to fund your purchase, working capital requirement, or inventory purchases of the newly acquired business. To qualify for an SBA loan you must be acquiring a healthy, for-profit business and be putting in substantial owner equity, although there are a number of other requirements.

Ideally, you can combine your personal funds with SBA loans to put together the total amount required to buy the business. If you have a good credit score and at least two years in business, SBA loans are probably the best option for you.

3. Seller Financing

Seller financing is a term that originally came from the real estate industry where the seller handles the mortgage instead of a financial institution. The idea has been replicated in the M&A industry. The buyer of the business gets funding from the seller instead of applying for a loan.

If you want to go for seller financing, be aware that such loans are issued at competitive interest rates. The advantages of seller financing include quick purchase and the option of tying the payment of the loan with business performance. If you're also going for an SBA loan, however, be aware that the SBA puts limits on the type of seller financing and how long the seller can give advice to a new owner post-sale. Adding the option encourages the seller to disclose all the facts about the business.

Check Out Acquira’s Free SBA Model Calculator

Now seems like a good time to take a moment to mention our Free SBA Model Calculator. The calculator will help you lay out different financing options for a business acquisition, with special consideration paid to SBA loans, seller financing, and equity injections (more on that later).

We’re providing the tool through Google Sheets to make it as accessible as possible. Please remember to make your own copy of the document and watch this quick video tutorial to learn how to use it.

Free Tool: Acquira’s SBA Model Calculator

This calculator is just one example of the training Acquira offers to Acquisition Entrepreneurs through our Accelerator Program.

The Accelerator Program is the fastest way to learn the intricacies around acquiring a business. From sourcing, vetting, and closing on the deal, the program will walk you through everything you need to know in order to acquire a 7-figure business within seven months.

Through the Accelerator, you gain access to:

- Acquira’s MBA-level M&A training and systems

- Our Investment Committee, which allows you test your investment thesis and business instincts

- Access to our vendors at preferred rates

- Access to Acquira as a potential equity investor

If you’d like to learn more about how we can help with your acquisition journey, fill out the form below:

4. Bank Loan

Conventional bank loans will always be an option to consider, especially if you are purchasing an existing business with substantial physical assets. But they might not be feasible for most people. That’s because banks usually require substantial physical assets belonging to the company as collateral for the loan.

If you have some assets with the bank, they could give you a loan to fund your purchase. They'll generally want a down payment of at least 30%. But there are additional requirements that might make this more difficult to obtain. For example, you need a great credit score and an SBA-backed guarantee.

5. Search Funds

This is an investment vehicle that is put together by business searchers who chose to use privately raised capital to search for, acquire, and grow privately held companies.

The leadership of a search fund – known as the search fund partners – will use the fund to pool private investors’ capital in order to fund the search and acquisition process. These often target smaller and midsized companies.

The process of setting up a search fund is relatively straightforward: Search funds are a unique form of business acquisition financing that involves pooling private investors’ capital to fund the search and acquisition process.

- Raise initial capital;

- Search for acquisition targets;

- Acquire a company;

- Grow the business;

- Exit for profit.

To launch a search fund, partners first need to raise enough capital to cover the overhead costs. They then conduct outreach to identify potential acquisition targets. Once they find a potential target they conduct their due diligence and, if they think it will make a good deal, enter into negotiations to acquire the business.

The ultimate goal of these funds is to increase the business value and eventually exit at a profit.

6. Crowdfunding & P2P Loans

Crowdfunding and P2P lending is yet another financing method to fund your small business acquisition. Through crowdfunding and P2P lending, different third-party online intermediaries connect the lenders/investors with the business buyers. You can get equity-based crowdfunding or reward-based crowdfunding.

The intermediaries charge you a service fee for funding. P2P lending doesn’t necessarily have to be done through third parties. Instead, you can leverage your own network of interested investors to fund the purchase.

7. Equity Injection

Some Acquisition Entrepreneurs are able to access equity funds, which can help fund their business acquisition by providing a cash injection toward the down payment. Usually for as little as 20% of the down payment all the way to 80%.

So, if the down payment is 10% of the transaction and the other 90% comes from debt like an SBA loan, then the cash injection would be 2% to 8% of the total purchase price.

In return, the fund could receive 2.5 times that amount in equity or 5% to 20%. In these cases, there would be a shareholders agreement to protect the rights of the minority shareholders and possibly some preferred dividends.

Of course, the exact terms of an equity injection can change greatly depending on the lender.

Alternative Financing Options to Purchase a Business

In addition to traditional financing options, there are alternative financing options available for business acquisitions. These options can provide more flexibility and creativity in financing a business acquisition. Exploring these alternatives can help you find the best fit for your unique situation and financial needs.

Debt Assumption

Debt assumption involves the buyer taking on the existing debt of the company being acquired. This can be a complex and risky option, as the buyer must carefully consider the impact of the debt on their credit score and cash flow. However, it can also provide a way to finance a business acquisition without having to secure new financing. By assuming the company’s existing debt, you may be able to negotiate better terms or lower interest rates, making the acquisition more financially viable.

Leveraged Buyout (LBO)

A leveraged buyout (LBO) involves using a significant amount of debt to finance the acquisition. This high-risk option requires the buyer to generate enough cash flow from the business to cover the debt service. However, it can also provide a way to finance a business acquisition with minimal upfront costs. In an LBO, the assets of the acquired company are often used as collateral for the loans, which can help secure the necessary financing. While this method can be risky, it can also lead to substantial returns if the business performs well.

Eligibility Requirements for Business Loans

To qualify for a business loan, you’ll typically need to meet certain eligibility requirements. This is crucial to understand when you are considering how to finance a small business purchase. Meeting these requirements is crucial for securing a business acquisition loan. These may include:

A Minimum Credit Score: Lenders usually require a minimum credit score to qualify for a business loan. The specific score needed can vary depending on the lender and the type of loan.

Business Experience: Lenders may require or desire a certain amount of business experience, typically ranging from 2 to 5 years, to qualify for a business loan.

Financial Statements: Providing financial statements, such as balance sheets and income statements, is usually necessary to demonstrate the business’s financial health.

Collateral: Some lenders may require collateral, such as business assets or personal property, to secure the loan.

Business Plan: A comprehensive business plan that outlines your goals, objectives, and financial projections may be required to qualify for a business loan.

It’s essential to review the eligibility requirements for each lender and loan option to ensure you meet the necessary criteria. The option(s) you choose to finance a small business purchase will likely change based upon your eligibility. Consulting with a financial advisor or M&A consultant can also help you navigate the application process and improve your chances of securing a loan.

Credit Score and Collateral

A good credit score and collateral are essential in securing financing for a business acquisition. A strong credit score can provide access to better interest rates and terms, making the financing more affordable. Collateral, such as business assets or personal property, can provide security for the lender, increasing your chances of securing the loan. However, it’s crucial to carefully evaluate the risks and benefits of using collateral, as it can put your assets at risk if the business does not perform as expected.

Business Plan & Financials

A well-written business plan and detailed financials are crucial in securing financing for a business acquisition. A comprehensive business plan should outline the goals, objectives, and financial projections of the newly acquired business. Financial statements, such as balance sheets and income statements, provide a clear picture of the business’s financial health. Working with a financial advisor can help you prepare these documents and provide guidance on the financing process. A strong business plan and financials can increase your chances of securing the necessary financing and set you up for success in your new venture. More on this in the next section.

Attracting Investors to Finance a Small Business Purchase

Attracting investors for a business acquisition can be more appealing depending upon your personal finances. You eligibility considerations for how to finance buying a small business become less of a challenge. You may also find that certain investors can help you succeed when you run the business as well. The challenge is attracting the right investors of course.

Understanding different business acquisition financing strategies can make your proposal more attractive to potential investors. Here are a few tips to help you find the right investor:

Develop a Comprehensive Business Plan: A well-written business plan that outlines your goals, objectives, and financial projections can be instrumental in attracting investors. Knowing how much investment you need, what return investors can expect, and how you expect to get them a return is useful.

Build a Strong Management Team: Investors want to see a capable management team in place to ensure the business is well-run and profitable.

Demonstrate a Clear Exit Strategy: Investors are keen to know how they’ll get a return on their investment, so having a clear exit strategy is essential.

Show a Proven Track Record: having past experiences and successes the industry of your potential acquisition is a major differentiator. Investors are more likely to trust someone that has experience.

Network and Build Relationships: Building relationships with potential investors and networking within your industry can be highly beneficial in attracting investors. This could be someone at a local meetup group, friends & family, chamber of commerce meetings, a local makers group, and more.

Conclusion

There are numerous ways to leverage different financing options to make a business purchase happen.

You should analyze which option of funding works best for you before you decide how to finance a business acquisition. In many cases, you can combine financing sources in order to raise the total amount required. Tools like Acquira’s Free SBA Model Calculator can help in this process.

The calculator is just one example of the training we provide through our Accelerator+ Program. If you’d like to learn more about the program and how Acquira can help with your business buying journey, schedule a call with an Acquira Representative right now through the form below.

Key Takeaways

- Different financing sources can be combined to help you acquire a business.

- The most popular source of funding is an SBA loan.

- An equity injection can be a great way to cover the down payment in exchange for a percentage of ownership in the company.

Acquira specializes in seamless business succession and acquisition. We guide entrepreneurs in acquiring businesses and investing in their growth and success. Our focus is on creating a lasting, positive impact for owners, employees, and the community through each transition.